Three Unlicensed BDC Operators Convicted by Ilorin Federal High Court

The Federal High Court in Ilorin, Kwara State, has convicted three unlicensed Bureau De Change (BDC) operators, according to a statement issued by the Economic and Financial Crimes Commission (EFCC), the prosecuting agency, on Tuesday.

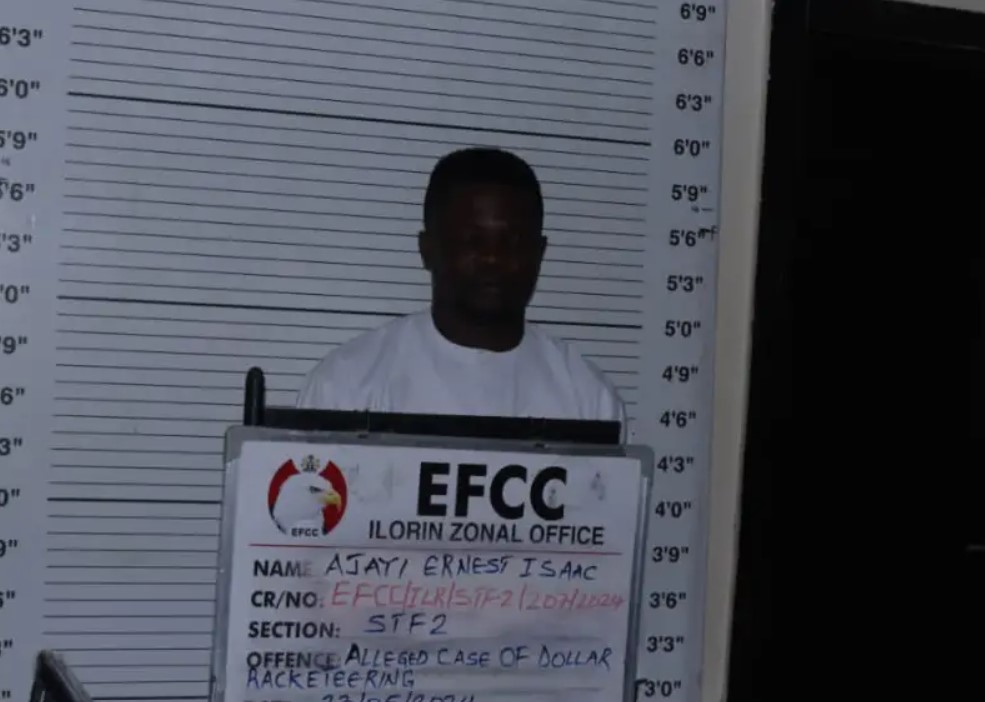

The statement identified the defendants as Mustapha Idris, Hassan Bala, and Ajayi Isaac, all natives of Chikanda in Baruten Local Government Area of Kwara State. They were prosecuted for operating a BDC without obtaining the necessary licence from the Central Bank of Nigeria (CBN).

Presiding Judge, Justice Olukayode Ariwoola, sentenced Mr Idris to 250 hours of community service, with no option of a fine, and ordered the forfeiture of CfA 33,000 and N323,000 seized from him to the federal government. Mr Bala was sentenced to six months in prison or a N200,000 fine, and his assets – Cfa 677,500 and N881,900 – were also forfeited to the federal government.

Likewise, the judge sentenced Mr Isaac to six months in prison or a fine of N500,000, while also ordering the convict to forfeit $31 recovered from him to the Federal Government.

EFCC brought the charges against them under section 57 (1) of the Banks and Other Financial Institutions Act, 2020, which prohibits any person without a valid licence from engaging in specialised banking or other financial institution business, including forex trading, in Nigeria.

Section 57(5) of the law provides that any person found culpable is liable to a minimum imprisonment of five years, a fine of at least N2 million and an additional fine of no less than N50,000 for each day the violation persists, or both imprisonment and fine.

If the offender is a corporate body, the law provides for a fine of N10 million and N200,000 for each day the violation persists.

EFCC arrested the defendants in July 2024.

They pleaded not guilty to the charges.

During their trial, EFCC prosecutors Sesan Ola and Andrew Akoja called witnesses and tendered extra-judicial statements of the defendants and different currencies recovered from the trio as exhibits.

The prosecution counsel urged the court to convict and sentence them accordingly.

Illegal BDCs in Nigeria

The activities of illegal foreign exchange operators are believed to contribute to the depreciation of naira and a conduit for money laundering.

In 2024, PREMIUM TIMES reported the demolition of shanties and structures of BDC operators in Abuja.

The office of the National Security Adviser (NSA) in February 2024, announced its partnership with CBN, EFCC, Nigerian Police Force (NPF), Nigeria Customs Service and the Nigeria Financial Intelligence Unit (NFIU) to combat the activities of illegal foreign exchange operators.

Cloud Tag: What's trending

Click on a word/phrase to read more about it.

Simeon Sayomi Oba Of Jebba Aishat Sulu-Gambari Anilelerin Mashood Dauda AGILE Programme Arinola Lawal Women Radio Michael Nzekwe Dele Momodu Iyaloja-General Okedare Albert Ogunsola Mary Kemi Adeosun Fatai Adeniyi Garba Agor Vasolar Consortium Wasiu Onidugbe Abdulkadir Bolakale Sakariyah Doyin Awoyale Abdulrauf Yusuf Aisha Abodunrin Ibrahim ASUU College Of Arabic And Islamic Legal Studies Alfa Modibbo Belgore Ahmed Saidu Rufai Shonga Budo Egba Razak Atunwa Taibat Ayinke Ahmed Shuaib Boni Aliyu Joseph Alex Offorjama Iyabo Dupe Adekeye Labour Party Talaka Parapo Local Government Fatimat Saliu Moses Adekanye Olaosebikan Buhari Junior Secondary School Certificate Examinations Saadu Yusuf Oyeyemi Olasumbo Florence Toun Okewale-Sonaiya Col. Ibrahim Taiwo Abdulrasheed Lafia Nurudeen Muhammed John Dara Muhammed Akanbi Monkey Pox Maryam Nurudeen Unilorin Sheriff Shagaya Aliyu Olatunji Ajanaku Wahab Olasupo Egbewole Yusuf Abdulkadir CCT Muideen Olaniyi Alalade Apaokagi Demola Banu Veterinary Teaching Hospital Ibrahim Abiodun Overland Aasiyat Bello Oyedepo Turaki Of Ilorin Ilorin Metro Park Budo-Egba Olukotun Of Ikotun TIC Umaru Saro SGBN Al-Hikmah University Teachers Specific Allowance Federal Neuro-Psychiatric Hospital Clement Yomi Adeboye Egbejila Omoniyi